[ad_1]

Monetary literacy is probably probably the most underrated but important abilities that we could possibly be educating our college students in faculties. It is a ability often handed down from parents to children, considerably impacting a toddler’s future monetary success. In relation to monetary literacy, earlier education is better.

If dad and mom are financially literate and move these abilities alongside, their kids usually tend to be financially profitable themselves. Conversely, if dad and mom lack monetary literacy or have poor monetary habits, their kids will possible inherit these poor monetary habits.

We would like all of our kids to succeed!

With this in thoughts, monetary literacy abilities have more and more grow to be recognized as an equity issue.

So, the place do faculties and lecturers begin? This weblog publish will share how any instructor can use the most effective monetary literacy sources on the market so as to add precious monetary literacy ideas to their curriculum.

What Can Faculties Do About Monetary Literacy?

Balancing the equation of constructing greater than you spend is essential for monetary success. Instructing these monetary abilities to our college students is so essential!

A number of years in the past, my classroom was acknowledged as one of the most financially literate within the nation.

As I taught monetary literacy abilities, I found that whereas college students had opinions about cash, many lacked the data to make knowledgeable monetary selections. This explicit expertise concerned an intensive simulation.

Whereas not each college can implement an in depth budgeting simulation, giving college students some publicity to monetary abilities can have a long-lasting influence.

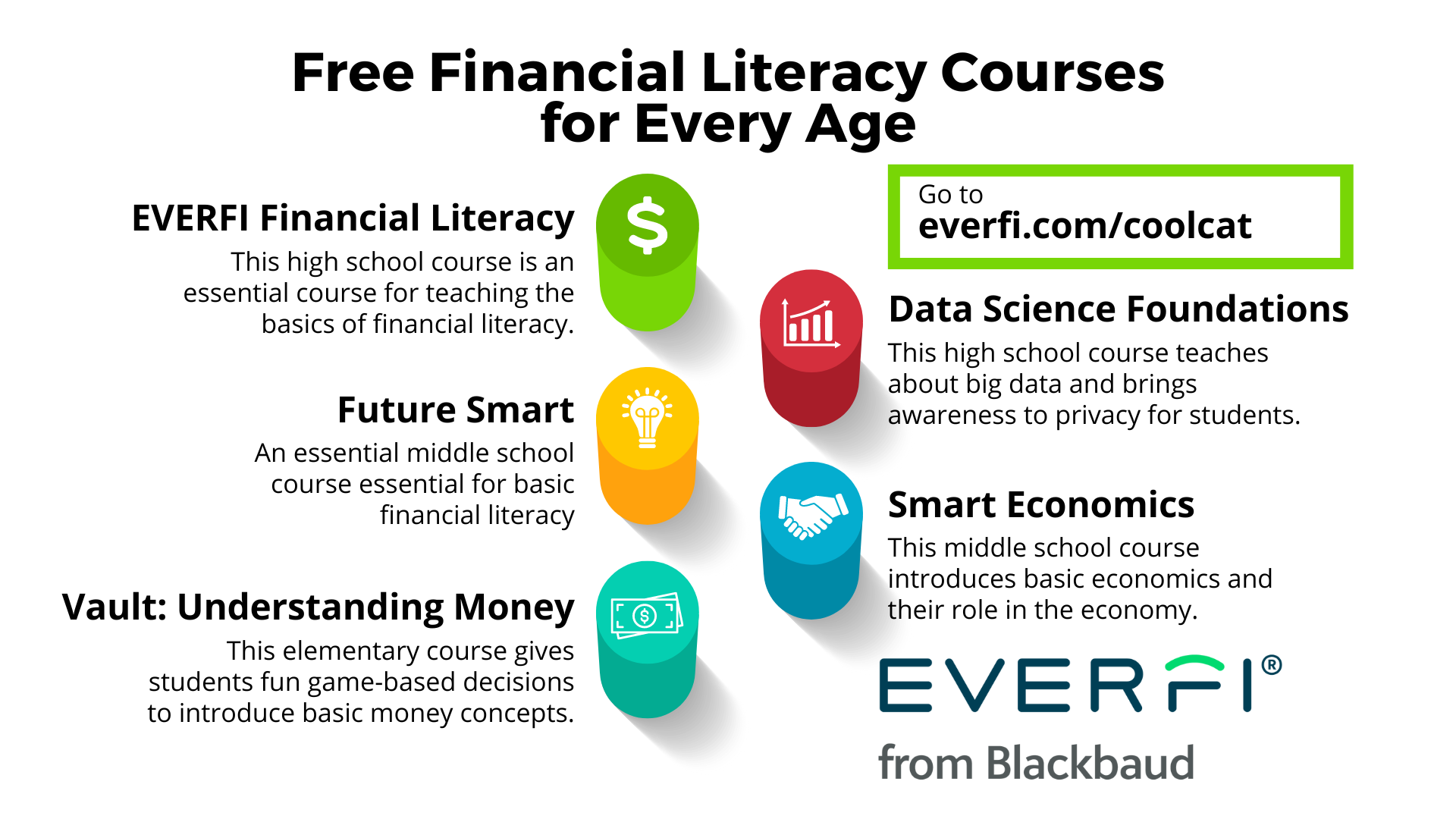

The programs shared on this publish just do that. That is the place EVERFI’s free programs are available. With EVERFI’s solutions, you’ve gotten a concise means so as to add monetary literacy to only about any course in your college.

Sure, Monetary Literacy Can Be Put In Each College

You possibly can empower your college students to grow to be financially literate at any age. By integrating monetary literacy training into elementary, center, and highschool curricula, we not solely equip college students with important life abilities but additionally make math ideas extra tangible and relevant.

On this weblog publish, I am going to advocate some free programs on monetary literacy and add one other essential course on knowledge analytics for highschool that can be associated to monetary literacy when it comes to understanding how our on-line knowledge is used.

All of those programs supply college students hands-on experiences in decision-making simulations, offering invaluable studying with out the danger of real-world monetary errors.

Advantages of those Free EVERFI Programs

- Every course is age-appropriate for the grade stage

- Programs include guides and glorious instructor sources for utilizing the programs with their college students.

- Elementary math in these programs makes ideas like addition and subtraction much more related and real-world. We’d like college students to grasp that math is related to their on a regular basis lives.

- The instructor dashboard lets lecturers monitor real-time in-course evaluation knowledge. This provides lecturers an image of the place college students are within the course of.

- The actions are game-based and real-world as college students make selections and be taught in regards to the penalties of these selections.

- The actions are compact sufficient to suit into your social science, math, economics, or different course as acceptable.

- All EVERFI classes come backed with an ISTE Seal and Digital Promise Product Certification.

Really helpful Monetary Literacy Programs:

Listed here are the 5 monetary literacy programs I believe each college ought to look to implement. Many states have a requirement to show monetary literacy, and others are taking a look at including it to their curriculum, so now’s the time so as to add this to your college’s curriculum.

1. EVERFI: Financial Literacy (High School)

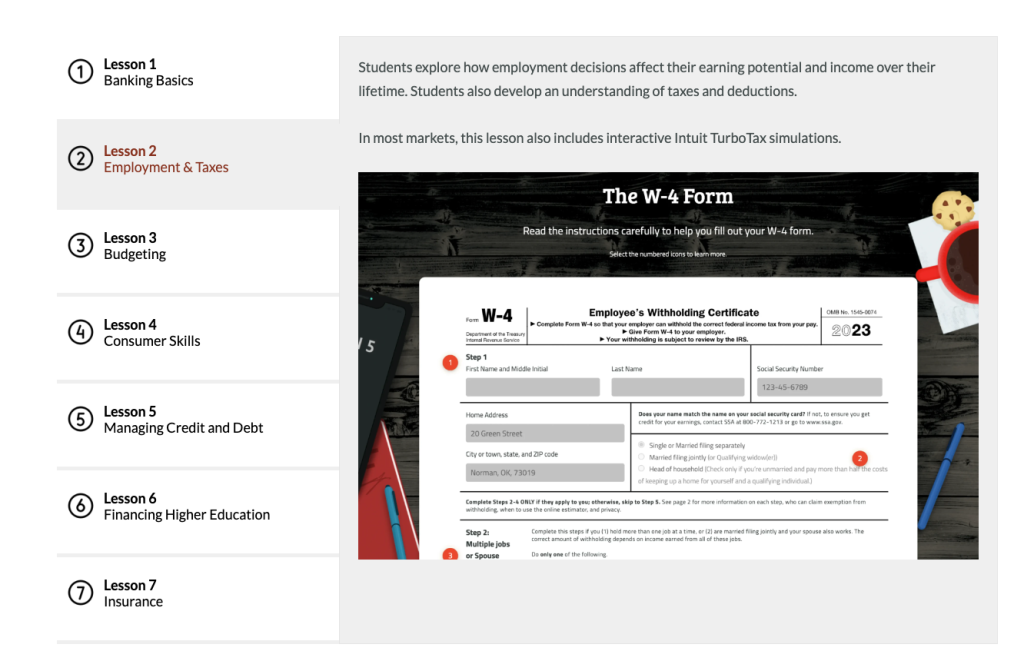

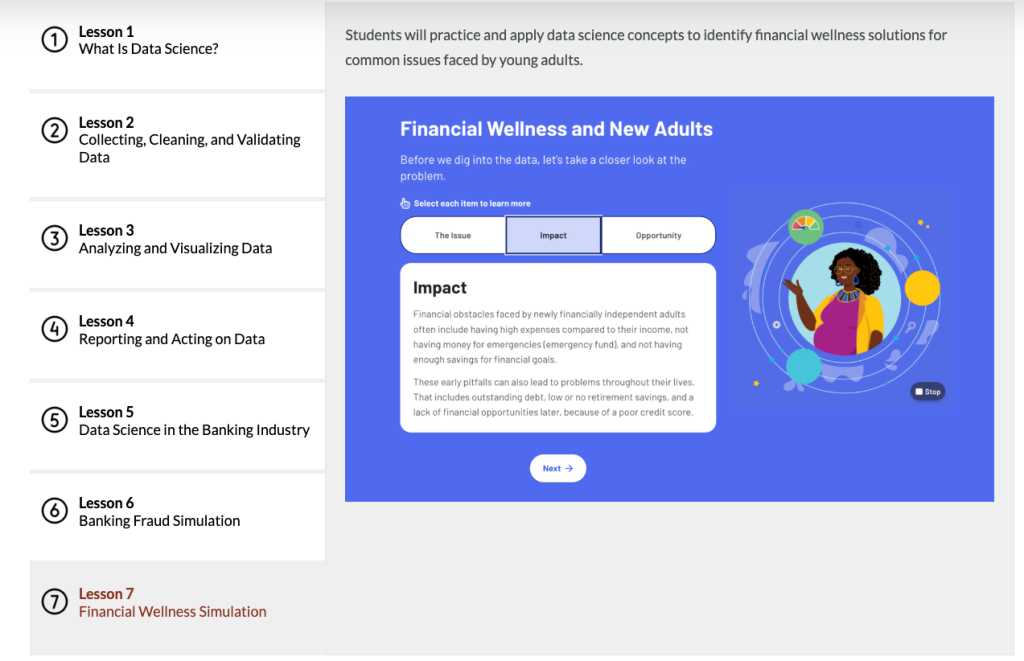

This basic monetary training course must be taught to each highschool scholar. Made related to highschool college students specifically, this 7-lesson (35 minutes every) interactive course brings real-life situations to college students and has been proven to positively impact students who take the course.

Subjects lined within the EVERFI: Financial Literacy course:

- Banking fundamentals, together with the monetary merchandise provided by banks

- The right way to full a W-4 and (in most areas) interactive simulations that assist college students calculate taxes

- Budgeting

- Purchases and on a regular basis monetary selections

- How credit score scores work and the charges related to bank cards

- Choices about additional training, earnings, and debt

- Insurance coverage selections, together with automobile insurance coverage and procedures in an accident

This course has interactive simulations and real-life situations that assist carry the true world into the classroom

2. Data Science Foundations and Exploration Labs (Excessive College)

Knowledge science is more and more a part of monetary literacy and is a quickly rising profession area. In at the moment’s data-driven world, understanding knowledge evaluation is essential for knowledgeable decision-making. Data Science Foundations and Exploration Labs is a superb match for the highschool curriculum.

Subjects lined in Data Science Foundations and Explorations Lab:

- Machine studying

- Knowledge visualization

- Database administration and knowledge assortment

- Fields in knowledge science

- How knowledge is used

- Knowledge science in banking

- Banking fraud and the way fraud is detected

- Widespread monetary wellness points for younger adults.

Via hands-on simulations and sensible workouts, college students perceive large knowledge and the way their private knowledge impacts bigger knowledge units. All of those examples are sensible and real-world.

3. Smart Economics: Economics Concepts (Middle School)

Economics is an important course for center college college students to grasp their position within the economic system and grasp basic enterprise ideas important for his or her future success. Smart Economics is a good begin for center college college students.

Subjects lined in Smart Economics:

- Shopping for and promoting

- Provide and demand

- How markets work

- Authorities and financial forces that form our world.

I additionally like this course as a result of many college students will finally work in enterprise. Enterprise levels typically characteristic economics programs, and I imagine college students should be uncovered to essential economics data earlier.

4. FutureSmart: Financial Literacy (Middle School)

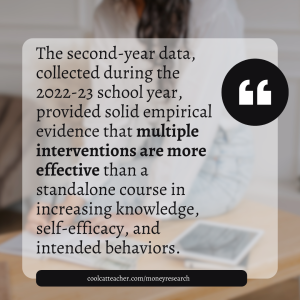

FutureSmart helps college students learn to make real-life private monetary selections in a hands-on story-based narrative with interactive workouts. This evidence-based course has been shown to extend the monetary data, monetary confidence, and self-reported monetary behaviors of center schoolers in comparison with their friends.

FutureSmart was independently validated to satisfy ESSA Stage III. This stage demonstrates that utilization of the digital course exhibits a constructive, statistically vital relationship with scholar’s monetary data, self-efficacy, and behaviors.

Moreover, the Financial Industry Regulatory Authority (FINRA), present in 2022 that people with increased monetary literacy seem like higher ready for short-term monetary wants, report spending lower than their revenue, and have an emergency fund put aside. So, this course can be on the high of my checklist as a vital addition to each center college curriculum.

Subjects lined in FutureSmart:

- Comparability buying

- Managing day-to-day bills, together with cost strategies

- Sensible use of debit playing cards and bank cards and figuring out the distinction

- Profession planning and revenue potential

- The right way to reduce out-of-pocket prices of upper training

- How a enterprise grows its revenue

- Investments

- Insurance coverage

- Planning for sudden bills

- Creation of a private portfolio of profession pursuits, plans for furthering training, and subsequent motion steps

FutureSmart equips college students with important data to make essential monetary selections that may influence their future, together with whether or not to pursue increased training and the way to handle related prices responsibly.

Moreover, this may be a good time for lecturers to debate the influence of GPA and different components from highschool because it pertains to future profession and training alternatives.

5. Vault: Understanding Money (Elementary School)

The Vault game-based expertise introduces college students to some primary life abilities in an age-appropriate means. Subjects lined:

- Budgeting

- Profession planning

- Wholesome borrowing habits

Let’s Introduce Monetary Literacy to All of Our College students

In conclusion, integrating these programs into your curriculum not solely makes math extra significant but additionally units college students up for a profitable future. By equipping them with monetary literacy abilities, we might help break the cycle of poverty and empower them to make sound monetary selections all through their lives.

Discover the free, easy-to-use monetary literacy programs offered by EVERFI at the moment. Your college students’ future success is determined by them.

Disclosure of Materials Connection: This can be a “sponsored weblog publish.” The corporate who sponsored it compensated me by way of money cost, present, or one thing else of worth to incorporate a reference to their product. Regardless, I solely advocate services or products I imagine might be good for my readers and are from corporations I can advocate. I’m disclosing this in accordance with the Federal Commerce Fee’s 16 CFR, Part 255: “Guides Regarding the Use of Endorsements and Testimonials in Promoting.”

By no means miss an episode

Get the 10-minute Trainer Present delivered to your inbox.

[ad_2]

Source link